We take a look at emotional investing and explain what you can do to avoid this mindset to improve your investment performance.

What is emotional investing?

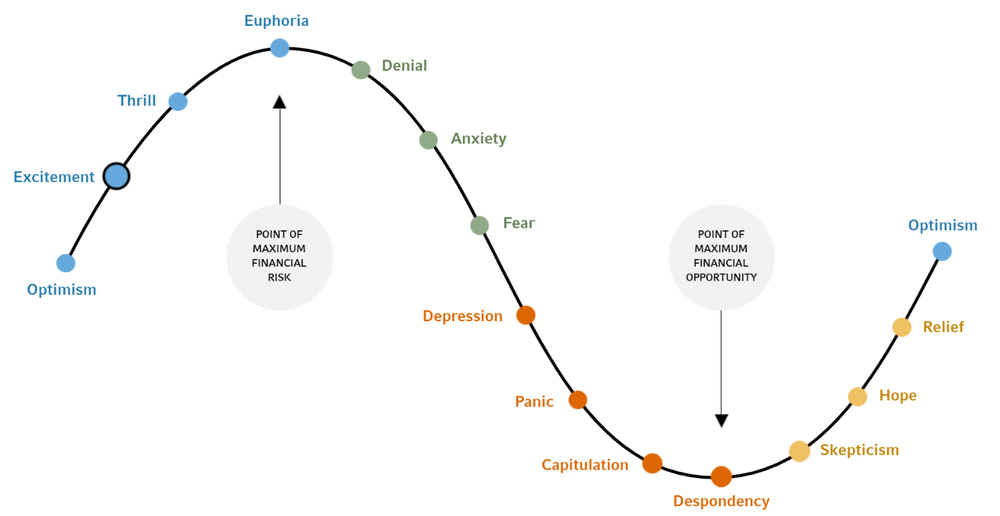

Any investment can be a real emotional rollercoaster even at the best of times. Unfortunately, emotion has proven itself to be one of the biggest downfalls for investors in their pursuit of financial independence.

Because of this, professional investors use tools to remove the emotion from any investment. In equity markets, an investor might use a stop loss on any equity they buy. Alternatively, they may decide never to hold more than 10% of their holding in any given share. This way they have put rules in place to protect themselves from losing money by chasing losses by being too emotionally involved.

By adopting rules, you are removing a lot of the emotion out of any investment.

How does this apply to property investment?

As a property investor, you should do the same. By analysing an investment objectively you are better positioned to make an informed decision as to whether an investment is in line with your financial objectives and risk profile.

Unfortunately, new investors are more prone to emotive decisions when investing. This is especially the case with property, as it is tangible. Tangible objects often create an emotive response.

With this in mind, we have created a list of do’s and don’ts to help take away the emotion from buying an investment property.

Property do’s

Here is a list of important things that you should do to avoid emotional investing.

1. Identify your financial objectives

Before you take on any investment, it is important to identify what your investment goals are and the reason as to why you have them. In investment we call this finding your why’s. Any investment goal should be specific to you. It should also fulfil a purpose. Once you understand what you want and need to achieve and why you need to accomplish it, you are in a position to formalise an investment plan.

Taking this approach gives you an advantage as it helps you identify whether any potential investment is aligned to your financial goals.

2. Establish a timeframe

Property investment has a number of fixed costs. You have to pay solicitors fees to perform property searches. Then there is stamp duty to pay and changes to mortgage interest tax relief which makes buying property a longer play to see profit.

Taking a long-term view centred around positive cashflow and capital appreciation is a way of using property to create financial independence. However, exactly how long is long-term? And does this fit into your investment timeframe? are good questions to ask.

3. Identify the correct property class

Before committing to buy property you need to ascertain your investment timespan in conjunction with your financial goals and risk profile. This will help you to establish the type of property which is most suited to your investment needs.

Some property investors will have one eye on retirement and will work to secure a high-yielding property such as student pods to replace lost income for retirement. Whereas a younger and risk adventurous property investor will look to maximize capital growth by investing in property where they can secure a discount to market value so they can re-mortgage and quickly build up a property portfolio.

4. Take a holistic approach

Any new investment should be considered as part of your existing investment portfolio. This doesn’t just apply to your other properties. My looking at your total portfolio you are better placed to evaluate how any new investment fits into your financial goals. For example you may already have enough income when your pension kicks in so estate planning may be more important.

You should look into taxation rules as this will determine your real returns. Our article on Inheritance tax planning is helpful if you wish to leave a legacy. Whilst if you are looking at selling for profit you are subject to capital gains tax rules and regulations.

Alternatively, your tax situation may have changed. If you all of a sudden become a higher rate earner then you need to think about which option is best for you under these circumstances. Many investors at this point often prefer to buy a property through a limited company as there are tax advantages in doing so.

5. Diversify your property portfolio

All investment carries risk. As an investor, you should always ask yourself what if? Whilst you cannot know the future, by having contingencies built into your investment plan you are eliminating undue risk.

Diversification doesn’t just mean having more than one property. It could be having property in different locations, or even different types of property such as commercial as well as residential.

Alternatively, diversification may be about investing in other asset classes altogether. Gold for example tends to be a good hedge against a downturn in the economy.

The clear point is to move outside of your emotional comfort zone and expose your portfolio to a more diverse way of investing.

6. Undertake due diligence

Before you invest in a property you need to evaluate it fully. Whilst returns may look good on paper, if there are large service costs attached to the property then the net yield is likely to be significantly lower.

Likewise, if you buy an older or poorly built property, there could be costly repairs to be done in the future. As an investor, this is your responsibility and will affect your bottom line.

7. Practice patience

When choosing the best property to invest in there needs to be a careful analysis of your circumstances and investment objectives. The search for the right investment can take longer than expected.

Practicing patience is key. Any property investment should be carefully evaluated and not an emotive want. To put it simply, is it correctly aligned with my financial goals?

Property don’ts

Below is a list of emotive investing mistakes that novice property investors often make.

1. Don’t buy your dream home

When scanning through Zoopla or Rightmove remember why you are doing so. It is easy to be swept away by the thrill of investing in a new property and visualising yourself living there as a second home. All investments should be about the balance sheet first. Does it fit in with your financial plan? If the answer is no, then move on regardless.

2. Don’t fear missing out

Many property companies sell on urgency. At Esper Wealth we believe this is the wrong approach. You should only invest when the time is right for you. Remember there will always be another opportunity which will come along.

3. Don’t overpay

Impatience and optimism are the two of the main reasons why property investors overpay for property. If you feel a lot of excitement when evaluating a property; ask yourself am I being emotive? If the answer is yes then sleep on it before committing.

4. Don’t rush in

If you are considering buying a property in which you have limited experience then don’t rush in. There could be several disadvantages to the property type which you have yet to think of. Alternatively, you could be paying over the odds. By taking your time you are gaining valuable experience to eventually secure the deal which is right for you.

The Esper Approach

At Esper wealth, we offer an alternative approach to investing. For all prospective investors, we offer a free financial review with an experienced investment manager. Your appointed manager will spend time getting to know you so that he or she can fully understand your investment objectives and risk profile. At the end of the review, they can point out areas for you to look into. Likewise, they can tell you certain properties to avoid as they don’t suit your investment needs.

You can choose to have a formal or informal review. A formal review is more comprehensive and we will undertake a full fact-find. From this, your consultant will be able to formulate a summary of needs report. This report will highlight your risk profile and investment objectives. Should you decide to buy property as a result of this advice, you will receive a suitability report. This is a formal document that explains why the advice was given.

If you prefer not to discuss your financial details then an informal review may be a better choice. Your consultant will talk about the advantages and disadvantages of each type of property. However, they won’t be giving any specific advice.

If you would like a receive a free financial review then contact us to arrange an appointment.