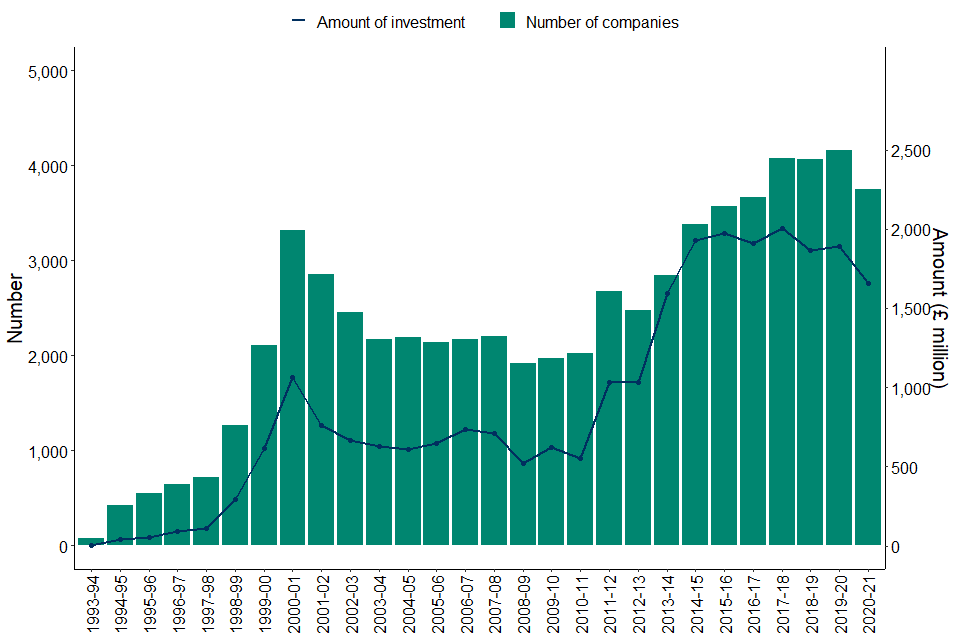

Since its inception in 1994, the Enterprise Investment Scheme has proved to be an astounding success. The scheme has successfully bridged the funding gap between early-stage growth companies and investors by offering significant tax breaks.

To date, the scheme has helped raise investment for over 32,965 companies, raising £24 billion in the process. Yet interestingly, many investors still haven’t heard about this government-backed scheme.

In this article, we take a look at the Enterprise investment scheme and explain its benefits and pitfalls to prospective investors.

What is the Enterprise Investment Scheme?

The Enterprise Investment Scheme or EIS Scheme for short is a government-backed scheme that helps early-stage qualifying UK companies raise funds to expand their business.

How does it do this?

The scheme gives major tax breaks to investors who buy shares in qualifying early-stage companies. These benefits include:

- income tax relief

- tax-free growth

- capital gain deferrals on other investments

- inheritance tax relief

- loss relief

As an investor receives lots of tax breaks by investing in EIS qualifying schemes, they are more likely to invest. This then potentially offers a win-win for the company and investor. The company can raise funds more swiftly and the investor has a better investment due to the tax breaks on offer.

Why does the government offer such good incentives?

The government is entrusted with several functions. One of those functions is to generate economic growth. The government recognises that one of the best ways to create growth is by helping smaller companies grow. When a company grows it is more likely to employ more staff, and generate more profits. Furthermore, it helps the workforce indirectly.

- Employing more staff. This is good for the economy as increased jobs reduce unemployment which is a burden on the state.

- Generating more profits. As a company records more profits the government receives more revenue through corporation tax. This income is used to fund pensions, education, health and many other important services.

- Workforce quality. Talk business states “As more jobs are created, more employees gain experience, often making a step up in seniority because start-ups look for cost-effective talent. This means that even if those companies do not perform as expected, or fail, there is a net gain for the British economy in its access to a more experienced and skilled workforce.”

EIS analysis

The government has calculated that the loss of tax from investors (who invest in EIS schemes) is more than compensated by the increased revenue these companies will generate for the economy in the longer term. City AM has recently estimated that the cost to the government in tax relief alone between 2009 to 2019 exceeded £3 billion. Yet the scheme has been going since 1994 and has been kept on by both Labour and Conservative governments. The reason for this is simple: “it benefits the economy by supporting innovation, which in turn increases productivity, creates jobs, and boosts growth. Our research suggests that in the long term it makes the Treasury money.”

What are the benefits of EIS for the investor?

The benefits to the investor are huge. Below we explain the various tax benefits related to Enterprise Investment Scheme.

Income tax relief

With an EIS qualifying investment, you receive income tax relief at 30%. This means for a £10,000 investment you can claim £3,000 in income tax relief irrespective of how the investment performs. The enclosed government link shows you how to make a claim.

You can invest up to £1 million in EIS qualifying schemes and receive full relief. For knowledge-intensive industries, this investment amount rises to £2 million in any given tax year.

Tax free growth

All EIS qualifying investments are exempt from capital gains tax (CGT). This means all profit goes directly to the investor without any tax on your profits.

Under current rules, normal investments are subject to either a 10% or 20% capital gains tax depending on your income, once you’ve breached your capital gains tax allowance. For certain investments like property CGT is levied at a higher rate. You can find out about Capital Gains Tax, here.

Capital gains tax deferrals

A gain made on the sale of other assets (eg property, equities, etc) can be reinvested in EIS shares and deferred over the life of the investment. There’s no upper limit on the value of gains that can be deferred.

So if an asset was sold for £40,000 and cost £10,000, this would result in a gain of £30,000. This £30,000 would need to be reinvested in EIS-qualifying shares in order to defer the gain.

There are time constraints too. To qualify for deferral relief, the reinvestment needs to be made either up to 12 months before, or up to three years after, the original gain was made.

The gain will be deferred until the earliest of any of the following events:

- The EIS shares are sold.

- The company ceases to be EIS-qualifying within three years of investment.

- An investor ceases to be a UK resident within three years of investment.

When the deferred gain comes back into charge, it’s subject to capital gains tax at the relevant rate at that time.

A deferred gain that comes back into charge can be deferred again if it’s reinvested into a new EIS-qualifying investment. If the investor dies owning EIS shares, the gain will be eliminated.

Inheritance tax relief

EIS shares qualify for Business Property Relief (BPR). This means they can be passed down to beneficiaries free of inheritance tax, providing they have been held for at least two years at the time of death.

Loss relief

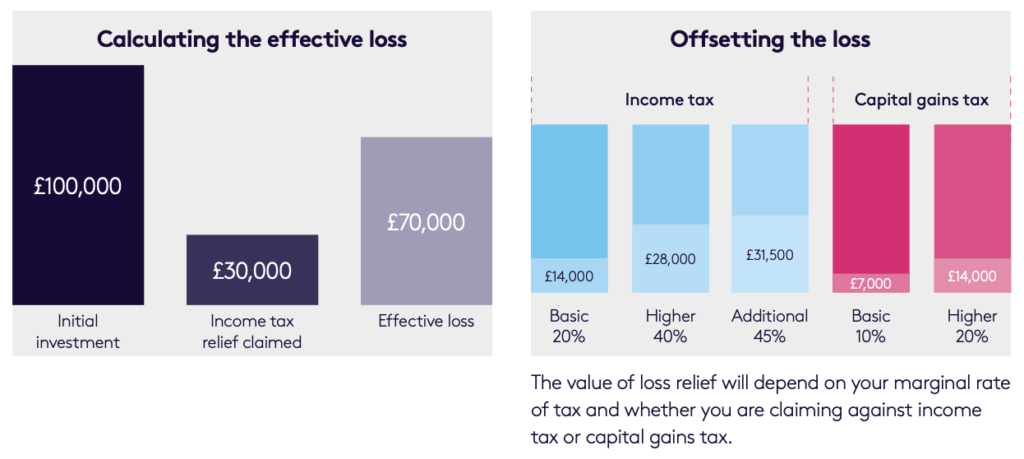

If shares are disposed of at a loss, the investor can elect that the amount of the loss (less Income Tax relief) can be set against income of that year or the previous year. This avoids a situation where the loss is set against capital gains, allowing far more flexibility.

The table below shows how you can offset losses on an EIS-qualifying investment of £100,000. When offsetting the loss you can choose to offset against either income tax or capital gains tax. Usually offsetting against income tax will provide you with the most tax relief.

In the above example, an investor who invests £100,000 into an EIS-qualifying investment will receive £30,000 back from claimed income tax relief. Should the investment completely fail the investor can claim back the loss against income tax. An additional ratepayer would be eligible to claim back 45% of the £70,000 loss. This in effect reduces losses to £38,500 on a £100,000 investment.

EIS in action

In the table below we provide an example of three scenarios of investing £10,000 in an EIS-qualifying company.

| Case 1 | Case 2 | Case 3 |

| The company does well and triples its value and you hold the shares for three years | The company value stays the same | The company closes and your shares are worth nothing |

| Investment = £10,000 | Investment = £10,000 | Investment = £10,000 |

| Income Tax relief = £3,000 (as a reduction in your income tax bill) | Income Tax relief = £3,000 (as a reduction in your income tax bill) | Income Tax relief = £3,000 (as a reduction in your income tax bill) |

| Share sales = £30,000 | Share sales = £10,000 | Share sales = £0 |

| Your gain = £23,000 (£20,000 profit from the sale plus £3,000 income tax relief). There is zero tax on profits. | Your gain = £3,000 (from the income tax relief) | At risk capital = £7,000 Loss relief on at risk capital @ 45% = £3,150. Your actual loss = £3,850 (£10,000 – £3,000 – £3,150) |

What are the rules?

There are several restrictions imposed on companies wishing to raise funds through this scheme. We list the key considerations below.

- Companies must be less than seven years old to qualify for raising under the EIS scheme.

- Companies cannot raise more than £5 million per annum under the scheme. There is also a maximum raise of £12 million for any company over its lifetime.

- Companies must operate in a qualifying trade

- Any company wishing to raise finance through EIS needs to have a full-time presence in the UK as well as having gross assets less than £15 million.

Otherrules must be followed for the investor to maintain the EIS benefits. These include:

- An investor must hold the shares for a minimum period of 3 years unless the company fails.

- An investor needs to be a UK resident throughout the duration of the investment

- The investor has to have a risk to capital. Otherwise, it would be seen as a tax avoidance scheme.

How do I get involved?

You can invest directly with the company that wishes to raise the funds. Alternatively, shares in the company may be offered to you from an investment firm or crowdfunding platform.

Should I invest in the Enterprise Investment Scheme?

This depends on you. If you don’t mind taking investment risks in pursuit of higher returns, then an EIS-qualifying scheme may be a benefit to you. This is because you can write off a large percentage of any losses, as well as benefiting from returns free from capital gains tax. These benefits are more pronounced for higher earners due to these underlying tax breaks.

However, just because an investment is EIS-qualifying it doesn’t mean that you should stampede towards any offering. It is important to remember that investments in small unlisted securities are speculative by nature and carry other risk considerations.

One important consideration is to understand that your capital is tied up for a minimum of three years before you can exit from your investment. Even then, you need to be sure that the company you’re considering investing in has an exit strategy in mind. Popular exit strategies include floating the company on an exchange or selling the company to a private equity firm.

Important questions to ask

Another important consideration is to understand the business model and financial solvency of the firm. Typical questions experienced investors ask are:

- Is the company forecasting strong growth?

- Are the forecasts realistic?

- Is the company cash flow positive? Or is it pre-revenue?

- What is the cost of sales?

- What are the experiences of the directors?

- Do the directors possess financial knowledge? i.e. Do they understand cash flow, income statements and balance sheets?

- Is the sector I’m investing in likely to perform well in the next few years?

- Does the company already have advanced assurance from HMRC?

If you are inexperienced as an investor, you should also speak with an accountant or an investment manager who can provide you with independent advice.

What other options are there?

Various investment schemes offer tax benefits to UK investors. SEIS-qualifying schemes offer considerable tax incentives as do venture capital trusts.

Leave A Comment