Smart contracts and tokens have become buzzwords for many executives across several industries. This applies to the real estate industry as well. The benefits of smart contracts on real estate are huge. Yet many people still know very little about smart contracts. In this article, we take a look at smart contracts explaining what they are, how they work and then explain their future impact on the real estate industry.

What are smart contracts?

According to IBM, “Smart contracts are simply programs stored on a blockchain that run when predetermined conditions are met. They typically are used to automate the execution of an agreement so that all participants can be immediately certain of the outcome, without any intermediary’s involvement or time loss. They can also automate a workflow, triggering the next action when conditions are met.”

How do smart contracts work?

Smart contracts offer a completely new way of approaching contracts. Instead of two parties signing duplicate copies of a paper agreement, smart contracts ensure compliance through blockchain technology. This reduces costs and simplifies the contract negotiation process.

Smart contracts offer a permanent and decentralized ledger of transactions that cannot be altered, deleted, or destroyed. Furthermore, they are completely transparent to all parties involved.

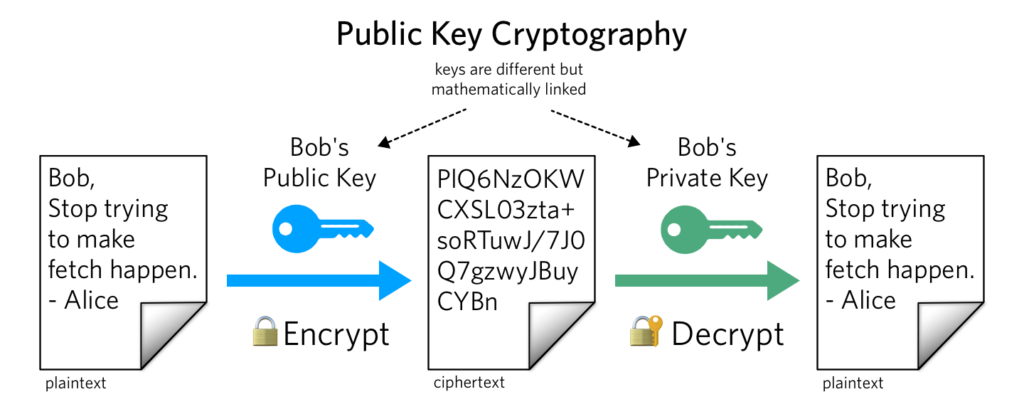

Just as importantly they work in chronological order with each entry being time-stamped. Security is achieved by the way data is stored. It uses blocks of data that are chained together with cryptology. This data is stored in a way that cannot be undone or altered. These records are transparent and can be accessed and viewed by anyone on the blockchain.

IBM states that, “A smart contract works through an executable code that runs on top of the blockchain to facilitate and enforce an agreement between untrusted parties without the involvement of a trusted third party. This code defines the mechanisms of the transaction and is the final arbiter of the terms. The readable terms of a contract are compiled into computer code that can run on a network.”

What are the benefits of smart contracts on real estate?

The benefits of smart contracts on real estate are immense. Here’s what Forbes had to say: “Blockchain is one of today’s biggest ground-breaking technologies with the potential to impact every industry.” Already over 15% of all financial institutions already currently use blockchain technology. Blockchain is “made for the people, by the people, and answerable to the people.”

We list the key benefits that this revolutionary technology can offer.

Remove middlemen

Smart contracts can reduce the cost of transaction fees in real estate. Blockchain and smart contracts eliminate the need for many people to be involved in the process.

This technology can automate processes involving document verification or mortgage approvals by writing a piece of code that will, in turn, cut down the lengthy and tedious process of buying a property.

As a result, blockchain technology can benefit the real estate industry. For example, a smart mortgage contract can speed up the mortgage process. There will be no need to continuously go back and forth amongst parties. Instead, the code for the smart mortgage contract will grant your mortgage request the moment all the documents and requirements listed are fulfilled.

Importantly as you are using less peoples time, eg bank clerks, property agents, and solicitors, these processes will significantly reduce and processing times.

Reduces costs

When you remove central institutions and reduce intermediaries’ time from the real estate exchange, you will be offered the service at a reduced cost.

It is anticipated that the costs associated with intermediaries will be reduced significantly through using this technology. According to a McKinsey report, it is estimated that blockchain could save businesses at least $50 billion in B2B transactions due to this technology.

Increased transparency

Smart Contracts require parties to agree on the conditions of the deal in advance. Then as each person does what they need to do the contract completes.

Once smart contracts are executed and implemented, they can not be altered or manipulated by anyone because they reside on the blockchain. As they can’t be tampered with they are transparent and trustworthy.

Better security

Blockchain offers complete security in terms of data protection as only people who are granted access to the information can see it. The cryptography mechanisms ensure that data is stored in an encrypted format, making it almost impossible to hack.

Speed

Real estate transactions are notoriously time-consuming. This is due to the processes involved. Deals can take weeks, months and for more complex commercial transactions longer still.

The main benefit of smart contracts for real estate is the speed at which deals can be completed. The processes are replaced by well-thought-out computerisation. Each transaction is executed automatically, making the process hassle-free for potential investors and property owners.

Improved accessibility

Property is very expensive and this puts ownership out of reach more many. However, Blockchain tech gives people other options. You can now buy a percentage ownership in property more easily as the smart contracts and tokens can offer partial ownership with rights. The smart contract determines how you can exit and tokens will provide liquidity.

This gives you more freedom allowing you to buy real estate in your choice of country, at a level of exposure that suits you.

Increased liquidity

Real estate is well-known for its low liquidity because of market entry barriers, complicated outreach, time-consuming transactions, etc.

Adopting a smart contract for real estate can boost your assets’ liquidity. Transactions will complete swiftly, whilst fractional ownership will support the trading mechanism, and the property will become globally accessible.

Moreover, tokenizing property facilitates digital exchange that helps list a property within a smart contract, where buyers can claim it when conditions are met. You can also fragment assets and sell them to multiple buyers if the conditions in the smart contract permit it.

Smart contract uses in real estate

Smart contracts offer a reliable way to carry out real estate transactions that require trust, transparency, and anonymity among all stakeholders.

There is a range of uses of this modern technology in real estate. Below we identify the most common uses.

Identity Management

Blockchain and smart contracts protect against identity fraud. This is an important aspect as online fraud has proliferated in recent years.

As smart contracts are built on decentralized, distributed ledger technologies. They give individuals complete control over their data and allow them to share the content of their data as they wish. This protects data security and can help an organisation deal with data protection regulations.

Smart contracts help ensure the following for effective identity management:

- Identity safety in digital assets

- The user decides what data they give out

- Easy and seamless KYC verification

Transferring property ownership

Traditional real estate contracts are becoming obsolete. This is because they are meant to define mutual terms of agreements and these can be ambiguous without clearly defined meaning. This is why we see parties frequently spending a lot of money and time arguing about the contractual terms.

Smart contracts reduce the vagueness of these traditional contracts.

In traditional contracts, the buyer is wary of transferring money before acquiring the property, whilst the seller is concerned about transferring the ownership before receiving funds. Notaries solve the trust issue, but they cause delays and increase the costs associated with transferring property ownership.

Smart contracts remove the trust issue and speed up the property ownership change process. This is because property ownership change contracts are executed automatically when the appropriate conditions are met. As soon as the buyer transfers payment to the seller, the smart contract can automatically change ownership of the asset. Or, a notary can instantly notify a buyer that the mortgage against a specific property is paid out by its previous owner, and they can safely purchase it.

Real Estate Investing

Traditional real estate investing is about buying a property directly. But if you are unable to afford this in an area that is going through gentrification due to regeneration initiatives you are unable to participate unless you go down the route of fractional ownership. This costs you a lot of time and money (solicitors fees) as you are still going down the traditional path of registering your interest at the land registry.

However, tokenised fractional ownership is an alternative blockchain-based investing method. It allows investors to buy and sell tokens quickly; and trade fractions of their tokenized ownership rather than the full ownership.

You can have smart contracts programmed for such real estate transactions, so they provide the holder’s income through rentals or dividends.

Lease rental agreements

It is becoming easy to rent out properties with the help of smart contracts. For example, Rent Peacefully is one platform that allows renting and listing properties on the blockchain using smart contracts.

One advantage tenants have on Rent Peacefully is that when a maintenance order is submitted to the blockchain, the smart contract realises this and locks the rent until the issue is solved.

How does it work?

The property owner initiates the smart contract process by programming the leasing conditions into a new contract, such as rent, property management fee, and payment frequency.

The occupier reviews the lease’s conditions via the online platform and digitally signs the smart contract once an agreement is reached.

The property owner also signs the contract digitally, which then transforms into a legally binding digital smart contract.

Our View

Smart contracts are here to stay as they offer many solutions to the business world. Where two parties are looking to do business but have issues about trust they can remove the need for a middleman. The video below explains how this can be achieved for crowd funding.

The benefits of smart contracts on real estate specifically are huge. They will reduce the cost and processing time of conveyancing. However, they won’t be mainstream in purchasing residential property until we see a fusion of legal contracts and smart contracts emerge. This will happen over the next few years as the technology becomes more mature and widespread and legal standards are adopted.

At Esper Wealth we see the immediate benefits of smart contracts in the tokenisation of real estate. This will improve the liquidity of property and open up the accessibility of property to the masses. Our recent cryptocurrency market report shows that real estate tokens are the best place to invest in Crypto assets.

If you want more information on how blockchain technology will impact real estate then click on the enclosed link.