In this short guide, we take a look at stamp duty and explain what it is and how it works. We then analyse its importance when calculating the real investment return. We hope that after reading you will have a full understanding of this form of property tax.

What is stamp duty?

When you buy property, the government usually taxes you for doing so. The tax that you pay for purchasing a property is called stamp duty.

However, stamp duty is not as simple as it seems. Depending on the type of property you buy, the purchase amount of the property, as well as your residency status, will impact the rate that you pay.

Furthermore, if you buy residential property for investment purposes, or as a second home, you are subject to an additional tax surcharge.

In the next section, we will explain how this works in the current tax year and provide some real-life examples.

What are the current stamp duty rates?

Since 2014, all the home nations have had a progressive stamp duty rate system. This means that instead of paying a single rate on the whole property price, depending on the cost of the property you’re buying you might end up paying one rate on a certain portion of the property and a different rate on another.

The image below shows how this progressive tax works for home movers. As you can see, a property that is bought for under £125,000 it is exempt from stamp duty.

If you buy a property on a higher threshold your tax is calculated in different tranches. The example below illustrates this point.

Let’s say you decide to upgrade your home and buy a larger property which is bought for £400,000. Your stamp duty would be calculated as follows:

- The first £125,000 would be tax-exempt. This means there is zero tax to pay.

- Between £125,001 and £250,000 you pay £2%. This results in £2,500 tax for this threshold.

- Between £250,001 and £400,000 you pay £5%. This results in an additional £7,500 of tax.

- The total amount of tax due on this example totals £10,000.

First-time buyers

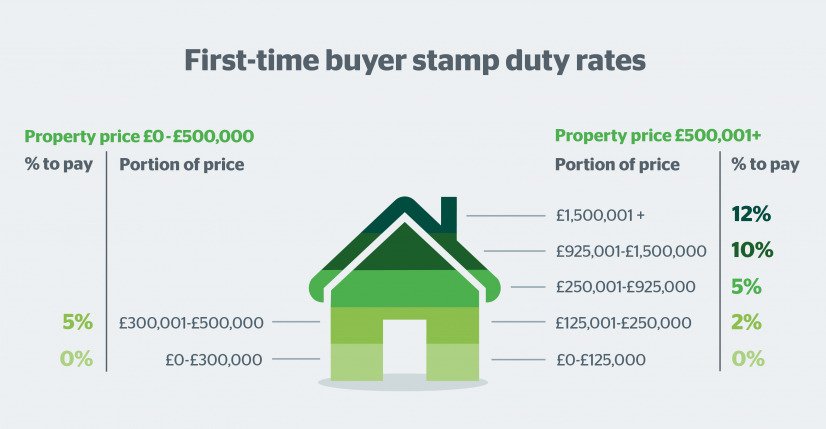

For first-time buyers, stamp duty is calculated slightly differently. They are exempt from tax on the first £300,000. Then stamp duty is levied at 5% on £300,001 to £925,000, 10% on £925,001 to £1,500,000, and 12% above £1,500,000. This means on a £400,000 purchase, the tax due is £5,000.

However, if a first-time buyer pays more than £500,000 for a property they will pay the standard rate. The image below shows how stamp duty works for first-time buyers.

Buy-to-let stamp duty rates

On 1st April 2016 the UK government introduced a stamp duty surcharge of 3% for holiday homes and investment properties. This was in part designed to deter would be property investors by making it more expensive to buy property.

The image below shows how the surcharge has impacted the cost of buying additional property.

This extra surcharge means that investors must pay quite a bit more in stamp duty tax. In the £400,000 property purchase example. A buy-to-let investor would have to pay an additional £12,000 in tax compared to a home mover. This means their tax obligation would be £22,000 for a £400,000 buy-to-let property.

Overseas Investors

Since 1st April 2021, all non-UK resident investors in UK residential properties have had to pay a 2% stamp duty surcharge. This is on top of the existing rate of tax, which is calculated on the property’s value.

This means for an overseas investor buying a home of £400,000 they would have to pay an extra £8,000 as a non-resident.

Using the above example an overseas investor’s total stamp duty purchase would be calculated as follows:

- For a personal home. On the £400,000 example, an overseas investor is subject to an extra £8,000 surcharge in addition to the typical rates paid by a home mover (£10,000 on a £400,000 Property). This results in an £18,000 stamp duty bill.

- For an investment property. The 2% extra surcharge is in addition to the 3% surcharge paid by UK investors. On the £400,000 example, the total tax consideration is £30,000 on a £400,000 house. This figure is calculated by adding the extra £8,000 overseas investor surcharge (2% of £400,000) to the investor surcharge of £12,000 (3% of £400,000), to the original £10,000 stamp duty bill.

However, there is an exception. If an overseas investor has spent 183 days in the UK over a 365-day period for 12 months before or after the transaction, they may be exempt.

Other considerations

If you buy another property before selling your old home, you will be charged stamp duty at a higher rate. Though this can be reclaimed providing you sell your property within a certain time period.

Scotland

In Scotland, there is a Land and Building Transaction Tax (LBTT). Apart from having a different name, taxation in Scotland is calculated differently. The following link relates to the UK stamp duty calculator for Scotland. The table below is taken from the government website for the current tax year.

LBTT rate | |

| Up to £145,000 | 0% |

| £145,001 to £250,000 | 2% |

| £250,001 to £325,000 | 5% |

| £325,001 to £750,000 | 10% |

| Over £750,000 | 12% |

In Scotland, there is zero tax to pay below £145,000. For first-time buyers this zero rate threshold rises to £175,000. When buying investment property there is a 4% surcharge.

Therefore a UK investor buying Scottish property valued at £400,000 would have to pay £29,350 in tax. This is calculated as follows:

- Investor Surcharge of 4%. This results in £16,000 of tax on a £400,000 property.

- First £145,000. The tax is zero.

- From £145,001 to £250,00. The LBTT is charged at 2%. This results in £2,100 tax.

- Between £250,001 to £325,000. The LBTT is charged at 5%, resulting in £3,750 in tax.

- From £325,001 to £400,00. LBTT is charged at 10%, resulting in £7,5000 in tax.

- Total consideration. On a £400,000 investment property, the tax due totals £29,350.

Non-residential property

Non-residential property relates to all property that is not used for residential purposes. This includes the following:

- commercial property, for example, shops or offices

- property that isn’t suitable to be lived in

- forests

- agricultural land that’s part of a working farm or used for agricultural reasons

- any other land or property that is not part of a dwelling’s garden or grounds

- 6 or more residential properties bought in a single transaction

Stamp duty on non-residential property is calculated differently. Rates are determined by whether you are buying a freehold or leasehold property.

Freehold non-residential property

The table below shows the rates for freehold commercial and other non-residential property.

| Property or lease premium or transfer value | SDLT rate |

|---|---|

| Up to £150,000 | Zero |

| The next £100,000 (the portion from £150,001 to £250,000) | 2% |

| The remaining amount (the portion above £250,000) | 5% |

On the same £400,000 example the calculated tax is as follows:

- On the 1st £150,000. There is zero tax to pay.

- Between £150,001 and £250,000. Tax is calculated at 2%, so it results in £2,000 for this threshold.

- Between £250,001 and £400,000. Tax is calculated at 5%, resulting in a £7,500 tax in this tier.

- Total. For a £400,000 freehold commercial property, the total taxation is £9,500.

New leasehold sales and transfers

When you buy a new non-residential or mixed leasehold you pay SDLT on both the:

- purchase price of the lease (the ‘lease premium’) using the rates above

- value of the annual rent you pay (the ‘net present value’)

These are calculated separately and then added together.

If you buy an existing (‘assigned’) lease, you only pay SDLT on the lease price (or ‘consideration’).

The net present value (NPV) is based on the total rent over the life of the lease. You do not pay SDLT on the rent if the NPV is less than £150,000.

| Net present value of rent | SDLT rate |

|---|---|

| £0 to £150,000 | Zero |

| The portion from £150,001 to £5,000,000 | 1% |

| The portion above £5,000,000 | 2% |

The government has included a comprehensive stamp duty calculator that you can use to calculate any tax obligation.

Potential rule changes

HMRC is currently consulting on potential changes to the Stamp Duty Land Tax (SDLT) rules for mixed-use property purchases and Multiple Dwellings Relief. If introduced, these changes will have important tax consequences for future property purchases. You can find out further information here.

Scotland. Non-residential LBTT

The non-residential LBTT rates and bands are set out in the tables below. As confirmed in the Scottish Budget, these will remain unchanged in 2022-23.

Conveyances

| Purchase price | LBTT Rate |

| Up to £150,000 | 0% |

| £150,001 to £250,000 | 1% |

| Over £250,000 | 5% |

Leases

| NPV of rent payable | LBTT Rate |

| Up to £150,00 | 0% |

| £150,001 to £2 million | 1% |

| Over £2 million | 2% |

LBTT on lease premiums is payable at the same rate and in the same bands as non-residential conveyances.

How I pay stamp duty? And when do I pay it?

You need to file a Stamp Duty Land Tax (SDLT) return within 14 days of completing your property. Failure to do this will result in a fine. Your solicitor will help you with this; it is one of the many functions your solicitor does when buying property.

Why is stamp duty important?

For home movers, stamp duty is the cost of moving home. Whilst for property investors, stamp duty is a more important consideration. This is because investors are more concerned with the balance sheet instead of fulfilling an emotional want.

Since 2016 the government has introduced a stamp duty surcharge for investment property. This means that an investor is significantly down when they buy a new property. As a result, a property needs to appreciate in value before an investor breaks even, then turns a profit.

More recently, more astute investors are looking to minimise their stamp duty costs. One way to do this is to buy a property that is priced at the lower end of the spectrum. Whilst this won’t remove the 3% surcharge, this strategy will lower the overall stamp duty obligation.

Fortunately, investors can still find a property with good growth prospects combined with a high investment yield. The best options typically tend to be located in northern cities where there is high demand. Although there are still good opportunities elsewhere. But investors will need to work harder to find a good deal, in part due to the higher stamp duty cost.

How to minimise stamp duty?

As mentioned in the previous section, one strategy is to buy a property that costs less than an average property. This will lower the cost of stamp duty.

An alternative option is to look at alternative forms of property investment. We enclose a list of popular strategies which investors’ use to minimise stamp duty tax:

- Buy purpose-built student accommodation. There are several advantages to investing in this asset class. One of these reasons is the way it is taxed. As this type of property is deemed commercial, there is no taxation to pay below £150,000. Typically student pods are sold below this threshold so are exempt from stamp duty.

- Another option is to choose to not invest in property indirectly. Since 2007, Real Estate Investment Trusts have proliferated. This is due to outstanding tax benefits. One of these is there is no direct stamp duty to pay. Similarly, bonds and funds offer the same stamp duty benefits. Whilst stamp duty is still paid by the investment manager, most funds, bonds, and REITs typically invest in non-residential property where stamp duty is levied at lower rates.

- Alternatively, you can choose to invest in property via contracts for difference or spread betting. With these options, you are not buying the asset. Because of this, there is no stamp duty to pay, either directly or indirectly. With spread betting, any profits are completely exempt from capital gains tax as well. This makes it a very tax-efficient form of investment.

What other taxes do I need to consider?

When investing in property, stamp duty is not the only tax that you pay. Any gains are subject to capital gains tax. Our article capital gains tax the basics explained shows you how to minimise this other tax obligation. Similarly, if you die and leave an estate you are subject to inheritance tax. There are ways to reduce your inheritance tax bill when buying property. So if leaving a legacy is important to you then it is well worth a read.

Other important considerations?

When buying a property there are extra charges to consider. Below we list the key factors to consider.

Solicitors fees

One of these factors is solicitor fees. Whilst costly, solicitors perform an important function. Solicitors undertake various searches to ensure your property has no nasty surprises. When buying off-plan solicitors perform extra functions to ensure your interests are fully protected.

Mortgage interest tax relief

Since April 2020, it is not possible to deduct any of your mortgage expenses from your rental income to reduce your tax bill.

Instead, you now receive a tax-credit, based on 20% of your mortgage interest payments.

For higher-rate taxpayers, this new system is less generous. Previously, higher rate taxpayers received 40% tax relief on mortgage payments. This is no longer the case. As a result, many higher rate higher taxpayers have decided to invest in buy-to-let property via a limited company.

Service charges and ground rent

When investing in property it is important to consider all charges. Service charges and ground rent eat into your investment yield. Any prospective investor should factor in these costs to work out the real yield from your prospective investment.

Management Fees and sundries

For investors seeking a passive investment, you will need someone to oversee your property investment. This is typically done by an estate agent who is up to date with all the rules and regulations in this increasingly regulated industry. Estate agents don’t work for free. If you opt for an agent to manage your property you will need to pay for their services.

Maintenance fees

When investing in property, there are likely to be maintenance fees. With older properties these fees tend to be higher. Whilst new build properties come with a number of guarantees.

Payment protection policies

More recently, insurers have started to offer specialist products to guarantee a tenant’s rental obligations. These products offer the landlord stability in the form of rental guarantees. However, such insurance policies are not free and should be factored into your rental yield.

The Esper approach to investing

When considering investment we take a holistic approach. We look at the real investment return to give our investors a realistic breakdown of any potential returns. We believe this transparency is one of our competitive advantages compared to many property companies which are more sales-driven.

As a company, we offer all prospective investors the option of a free investment review. This service is designed to give you the best advice that is tailored to your specific investment needs.

If you would like to know more about the Esper way of investment then contact us today to find out how we can assist you in achieving your investment goals.